Merchant acquiring trends in Spain, France, and Italy remain highly fragmented, shaped by local regulation, banking models, and market structure rather than a unified European approach. That fragmentation makes end-to-end payment processing difficult and drives growing demand for consistent POS features that support visibility, control, and reliable operations across markets. Understanding these differences is key to building and acquiring setups that work reliably at scale across markets.

Key Insights

- Across Spain, France, and Italy, data shows that merchant acquiring trends are shaped less by innovation speed and more by legacy market structures and local fragmentation.

- Differences in regulation, bank models, and distribution mean merchant acquiring remains fragmented across these markets.

- True end-to-end payment processing remains difficult to achieve, as responsibilities are split across acquirers, processors, POS providers, and value-added service layers.

- The relationship between merchant acquiring and processing is tightening, with clearer pressure on providers to deliver more integrated, reliable services.

- Demand for richer POS features reflects a shift toward using the POS as an operational tool, not just a payment endpoint.

- Overall, the findings suggest that performance in these markets depends less on individual components and more on how well the acquiring ecosystem is coordinated.

Don't have time to read more now? Sign up to our newsletter to get the latest insights directly in your inbox.

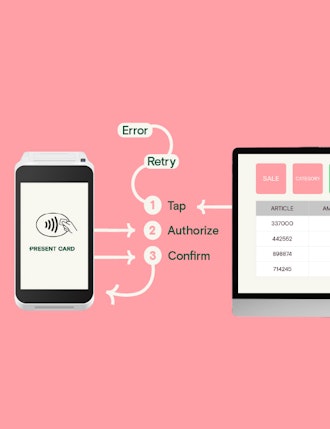

Consumers are making more in-store demands, are using a growing number of payment methods, and want the level of functionality that is typically associated with online shopping.

Where PayPal and such offer frictionless payment, the physical store is still tied into a physical card terminal working alongside a traditional point of sale (POS) unit, that is effectively just a cash register with a few more modern conveniences.

Responding to consumer demands, merchants are asking more from their merchant acquirers. Multiple standalone systems aren’t cutting it, and there is no one-size-fits-all option that can fulfill the ever changing needs of merchants who want solutions tailored to their individual businesses.

There is an opportunity on the horizon for merchant acquirers and merchant banks to deliver a stronger, more encompassing service through smart POS. The Merchant Acquiring Report 2019 says with 84% of Spanish and French citizens reported to be online, lessons can be learned from their interaction with eCommerce models.

As many as half of SMEs have said they are willing to switch payment solution providers in search of a better deal and more fluid integration. The work to retain merchants requires effort and a new way of thinking, onboarding of a whole new strategy.

Merchant acquiring experts including Partlya EcommBX PXP Financial AITE Group

In the Merchant Acquiring Report, we’ve talked to industry experts and payment analysts to delves into the current climate of the Mediterranean merchant space, we welcomed:

- Andréa Toucinho, Director of Studies, Prospective and Training at Partelya Consulting

- Ron Van Wezel, senior analyst for Aite Group’s Retail Banking & Payments practice

- Michael C.G. Charalambides, CEO & MD at ECommBX

- Kamran Hedjri, Board Member at PXP Financial

We explore the challenge to modernizing payments and offer guidance to help merchant acquirers transition into merchant solution providers, and explain how they can leverage POS solutions.

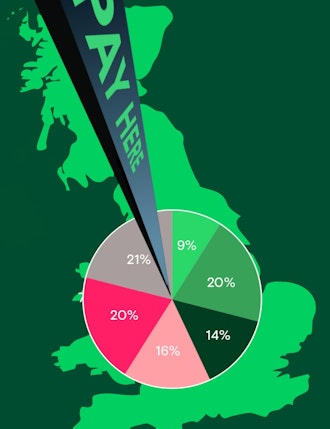

The Merchant Acquiring Report sheds light on the rapid changes impacting merchant acquiring, with an in-depth look at the playing field in Spain, France and Italy; the shift in merchant acquirers transaction ranking that happened over the last 12 months; and a look at the spending habits of the typical consumer.

Download the Merchant Acquiring Report now to discover how to adapt to the newest market trends.

Interested in reading more around this subject? Here are some useful articles…