When it comes to in-person payments, the landscape continues to change quickly. In today’s world, we’re seeing self-service payments being used to pay for fast food, fuel, payment terminals being installed at EV charging stations, in supermarkets and fashion stores, biometric payments and payments at the point of interaction.

And a new trend bubbling under the surface is in-person embedded payments. Let’s look at what this is and what it means for the in-person customer experience.

What are embedded payments?

Embedded payments are best known in the ecommerce and online space. They offer a way to buy items without leaving the website you’re using, instead they have special payment features built right into them. So when you want to buy something, it’s all done within the website in just a few clicks. You don’t have to go anywhere else and it offers a seamless customer experience.

So far so simple. Consumers likely do it countless times a day online without really thinking about it. But it’s when it’s brought into the physical world, that things get a little interesting.

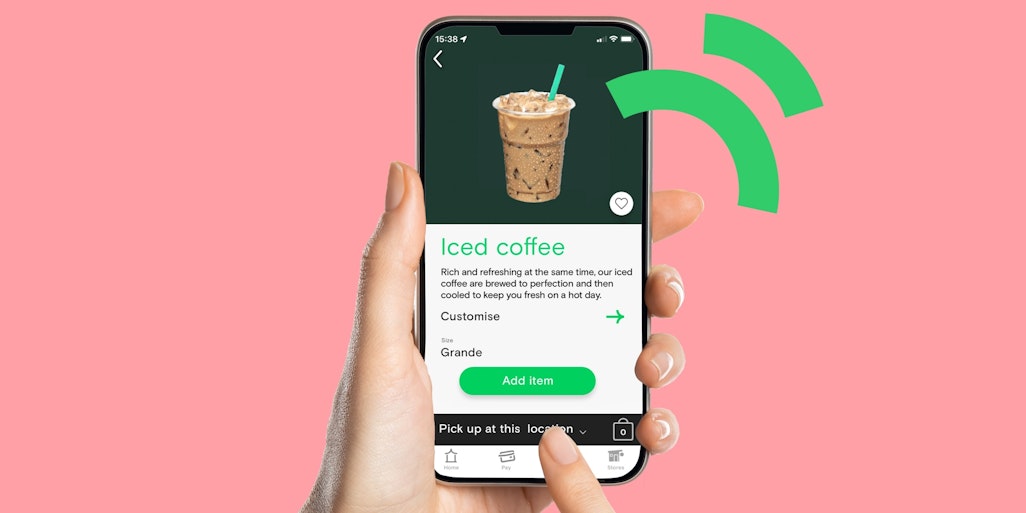

When users compare the checkout experience between online and in person, all agree that the app offers faster payments experience than paying at the till, or even using a self-service payment terminal.At the point where the customer is using an app for an in person payment, this is still an example of an embedded payment (the payment system is embedded in the app) but it’s to complete an in person transaction.

Application programming interfaces (APIs) and cloud computing technology is the backbone of this ecosystem, facilitating the easy flow of data between platforms and allowing payments to be made in a secure and efficient way.

The rise of embedded payments in physical retail spaces

Probably the best example of embedded payment being used in a physical store being used today is Starbucks. Registered customers add their payment data right there. They can then seamlessly order in store directly from the app, or even order ahead so no waiting in line when they walk through the door. Plus, customers even have the option of loading funds in advance for future payments – this simple feature enables them to create a weekly or monthly coffee budget and better track their spend.

And this isn’t just a fad of convenience used by a handful of customers either. In 2023, the app held more than $1.8 billion in deposits. That’s more than most banks.

Another well known example is the Uber app, where embedded payment functionality allows uses to hail a cab, browse a list of drivers and vehicles and pay for the service, all without leaving the app or having to pay the driver with cash or a card. By 2024 ride hailing had made Uber $19.6 billion US dollars.

With such a successful model and an efficient payments process, it won’t be long before more retailers and merchants switch to this kind of solution.

What are the benefits of embedded payments?

Embedded payment solutions like this offer a range of benefits to both businesses and customers.

Enhanced customer loyalty

If customers are bought into their favourite brand’s app in this way, to the point of pre-loading funds, they’ll stay loyal. It’s unlikely they’ll choose another coffee shop on a whim, when they’ve effectively already paid for their coffee with the app. This enables retailers to drive repeat sales on a huge scale.

Accessing the digital natives

Facilitating payments through an app is a great way to appeal to younger, digitally native, customers who expect a seamless user experience as a matter of course. Winning the loyalty of this demographic will ensure a bought in customer base into the future.

More customer data

By making the in-person payment system as digital as possible, businesses are able to gather more data about their customers. Factors like time of day, average order value, popular orders and location data can all be analysed. This in turn leads to better decision-making and more efficient business practices.

Reduced payment errors

By removing physical payments – whether cash or by debit or credit cards – merchants reduce the potential for human error. They’ll run more effectively and won’t lose out on valuable income. Embedded payment technologies also facilitate easy cross-border payments, eliminating the need to operate through a bank or other third party and avoiding potentially costly bank transfer fees.

More efficient shop floor

By reducing the need for human interaction and for customers to queue up, retailers are able to serve a higher volume of customers quicker. And with staff spending less time dealing directly with customers, staff costs can be cut and human resources freed up.

Better customer experience

For customers, their in-store shopping experience begins to replicate the one they experience online. Payments are simple and seamless. There’s no need to queue on arrival and total spend is super easy to track. With this ease and convenience, it’s not a stretch of the imagination to suggest loyal customers will easily convert to brand ambassadors.

ISVs and Embedded Payments

ISVs have proven their ability to offer superior payment distribution models. Businesses often adopt these payment systems earlier in their development compared to embedded payments since they typically prove to be more critical at early stages in the business’ lifecycle. However, as a business develops and grows, integrated or embedded payments often prove to offer a superior value proposition for merchants.

An integrated software and payments platform becomes a one-stop-shop for merchants, offering one single point of service, data acquisition, settlement, billing, and business insight. For more on this, see this article from Flagship.

The Future of Embedded Payments

Because of their convenience for both customers and merchants, embedded payments will remain a key part of the landscape into the future. As biometric technology and voice recognition technology advances and is paired with embedded payments on devices like smartphones, payment security will be enhanced making embedded payment not only convenient but safe. Smart contract technology is also becoming more prevalent, and can be used to track uses of embedded payments, ensuring that agreements are followed and upheld by all parties involved in a transaction, further ensuring payment security.

Technology continues to change the landscape of in-person payments, with this year predicted to see huge change impacting both customer experience as well as business efficiency and profitability. We’re eagerly watching the embedded payments space this year.